Paying in Full - Within the Budget

If you pay off your credit card statement every month, then you will want to use this page to understand how Actual helps you work with your credit card to stay Within the Budget. In this case, you will not create a separate Budget category for this credit card. Each transaction will be deducted from the Budget and Available funds as they are entered and categorized to a funded category.

If you are unable to budget for and pay your credit card outstanding balance, see the Carrying Debt page for a step-by-step guide on how to set up Actual and track this debt in a safe and sustainable manner.

tl;dr. If you don't budget funds you don't have and don't spend money that is not covered in your budget, you will not incur any new debt and always have enough funds to pay for your new credit card purchases whenever you want!

Starting our example Budget in July, we'll show you step-by-step how to handle credit cards in Actual.

Example

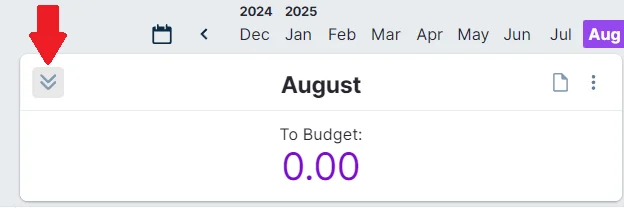

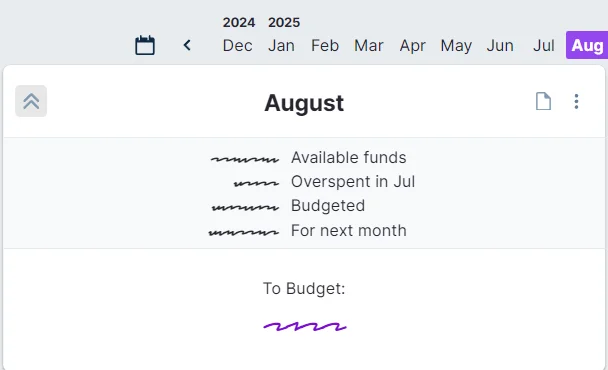

To show more top level information about your budget, hover over the top left corner of the header and press the expand arrows:

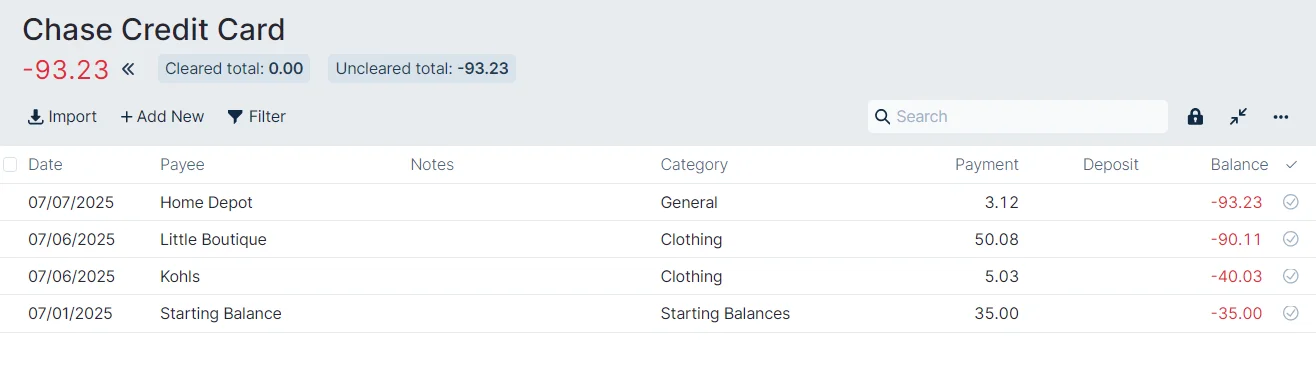

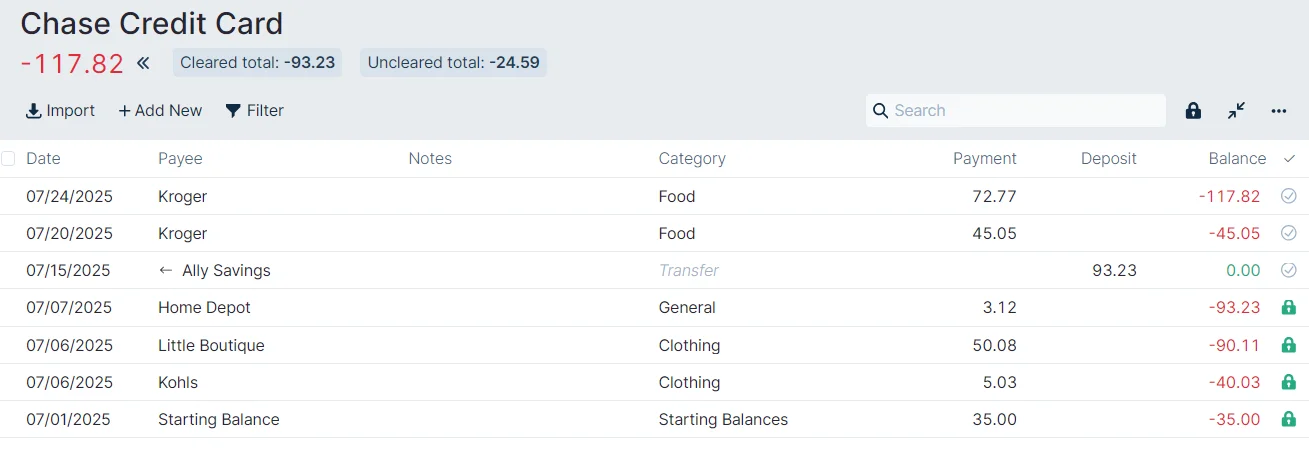

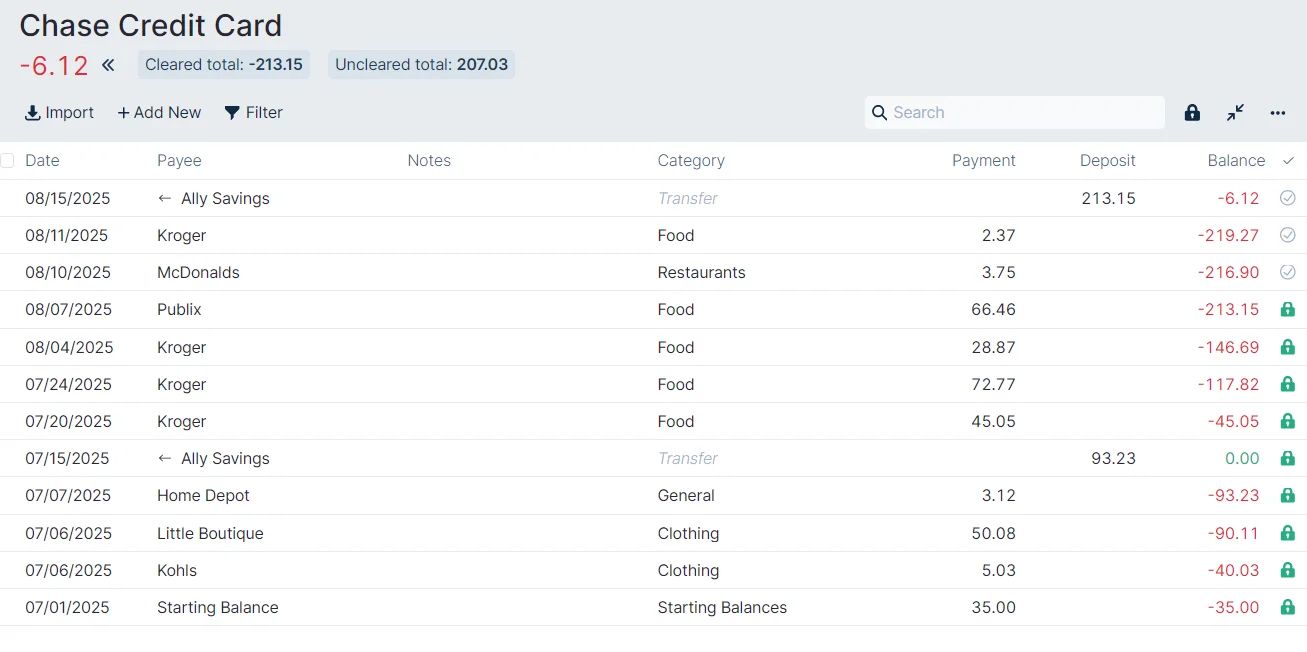

We started our budget at the beginning of July and we normally pay off our Chase Credit Card statement every month. We had some new transactions from June, so we entered a Starting Balance of $35.00.

Notice that money we owe goes into the "Payment" column.

Every time we use the card, we choose a category with a positive Budget Balance. Our account closes on the 7th of every month and our statement arrives a few days later. When the July statement arrives, our Chase account looks like this:

See Carrying Debt for instructions on how we set up our account display. You can see examples of how we dealt with our other two debt carrying credit cards, too.

We'll need the following informaiton from our July statement:

Chase Account Summary - July 2025

- Previous Balance: $564.23

- Payments Received: $564.23

- New Purchases: $93.23

- Cash Advances: $0.00

- Fees Charged: $0.00

- Interest Charged: $0.00

- New Balance: $93.23

If necessary, remember to enter a transaction for any interest and or fees charged and categorize them to a funded budget category.

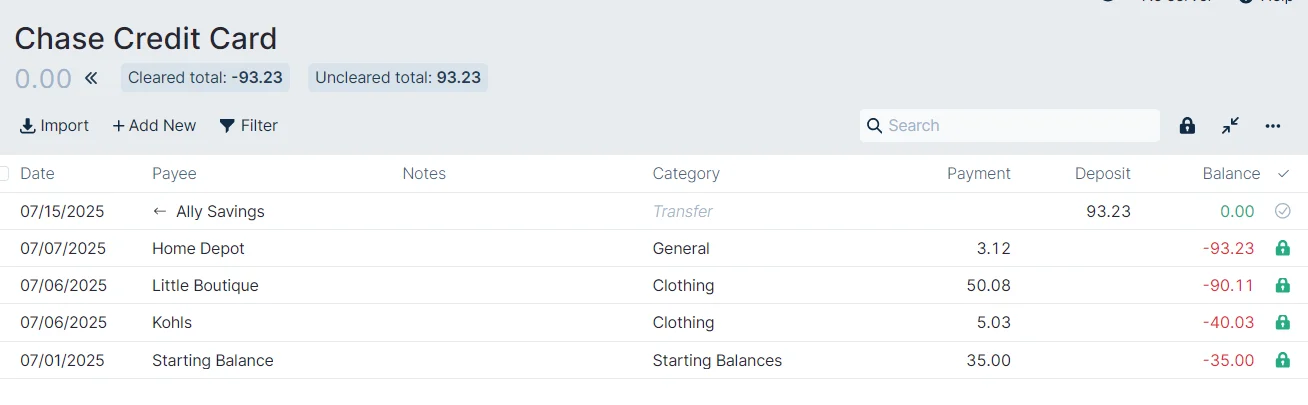

When we reconcile our account for this first month, we clear all of the June purchases and payments (which should be part of the "Starting Balance") in one lump. In our case their lump sum is $35.00.

We know that we accounted for all of these purchases as none of our Budget categories are overspent and our "To Budget" amount in the Budget header is not less than 0.00. We can pay our statement New Balance without worry, so we send Chase $93.23 from Ally Savings and we Make Transfer that amount from Ally to Chase as a deposit to our Chase credit card account.

We continue to spend in July, sometimes using our Chase card and always categorizing each transaction to a category with a positive Budget Balance, thereby spending Within the Budget.

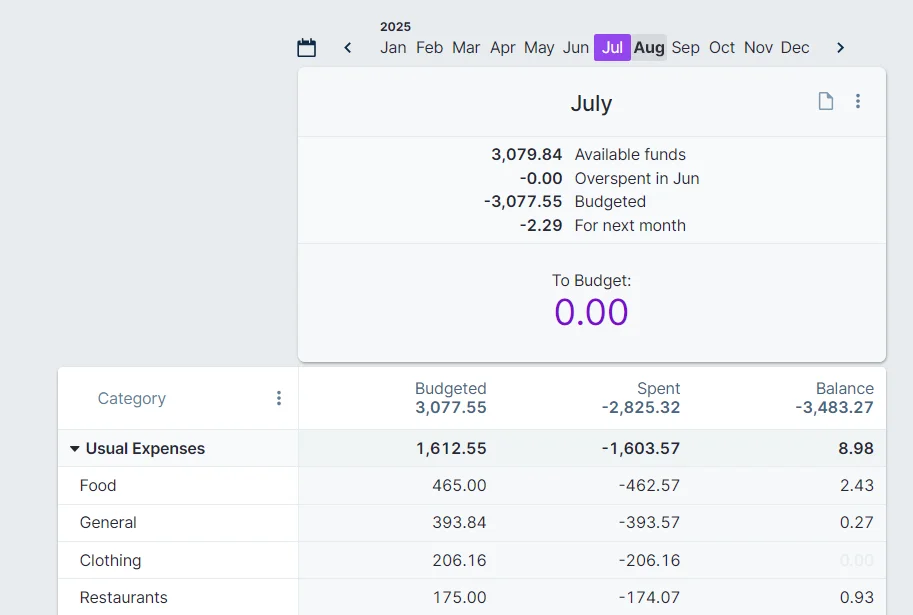

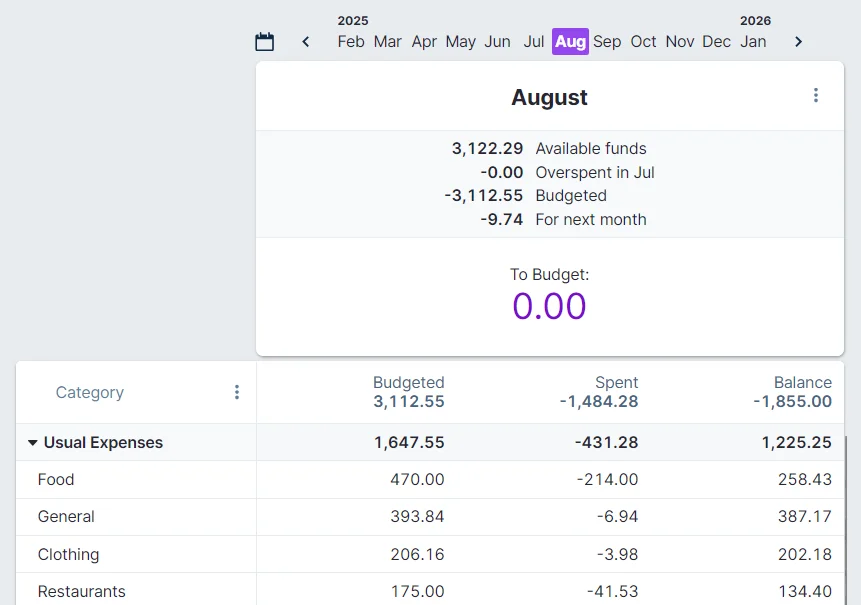

At the end of July, our Budget looks like this:

Our Chase credit card account looks like this:

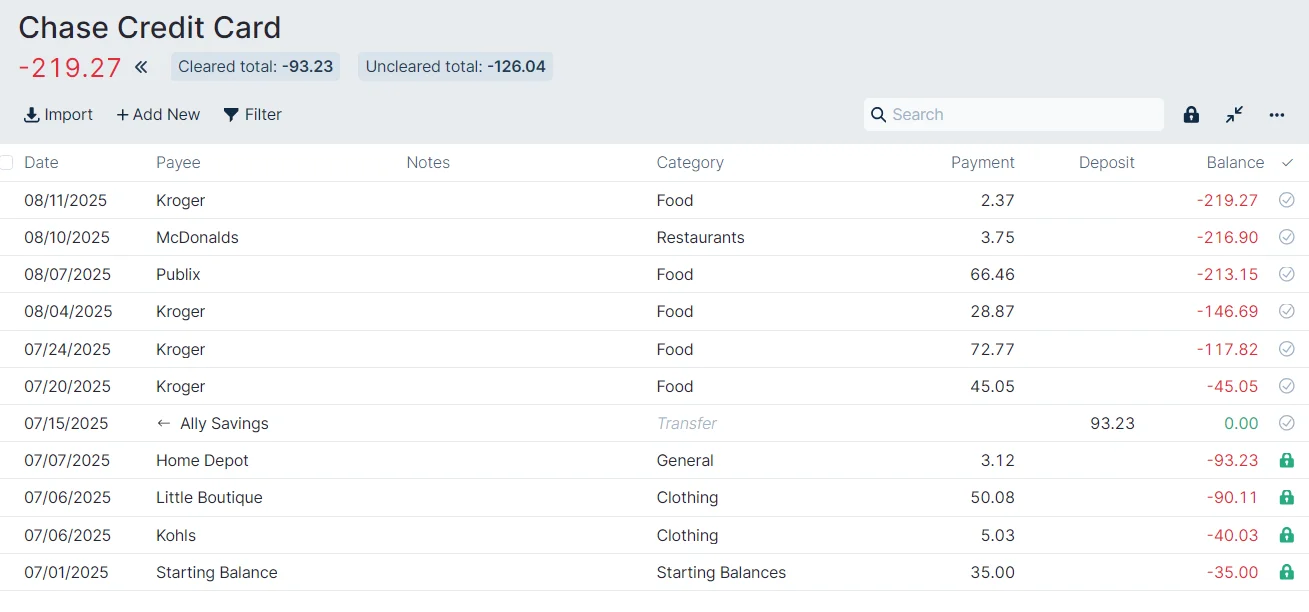

We set up our August Budget on the 1st and it looks a lot like our July Budget. We continue to spend and categorize each transaction Within the Budget and when our August statement arrives on the 12th, our Chase credit card account looks like this:

Chase Account Summary - August 2025

- Previous Balance: $93.23

- Payments Received: $93.23

- New Purchases: $213.15

- Cash Advances: $0.00

- Fees Charged: $0.00

- Interest Charged: $0.00

- New Balance: $213.15

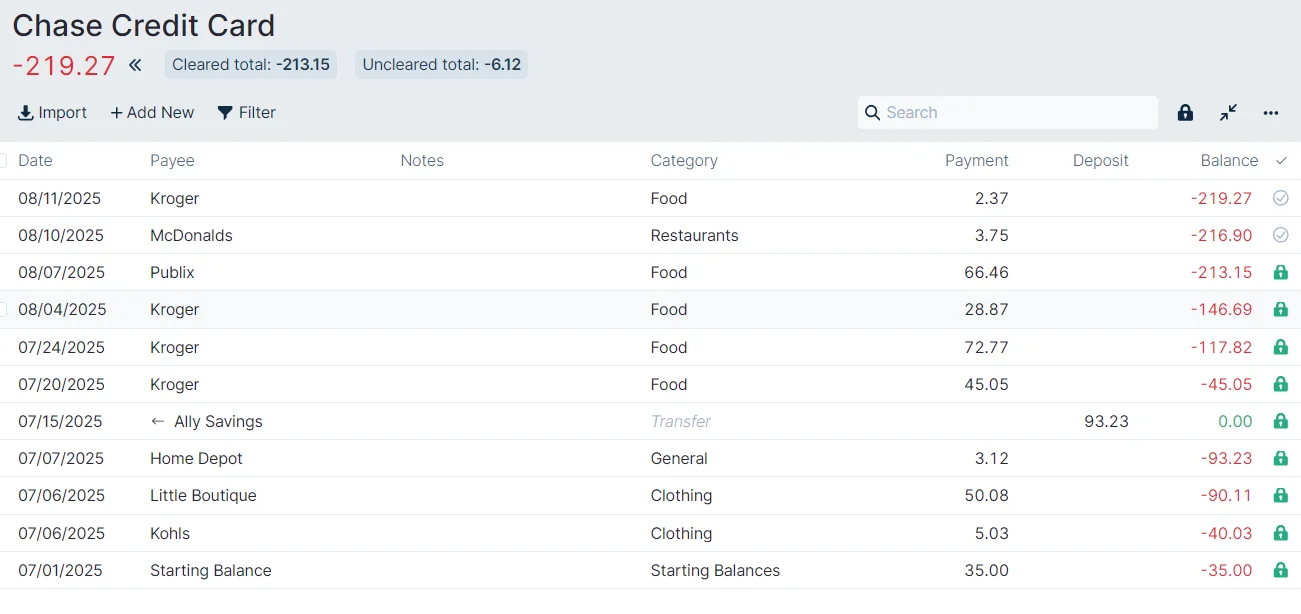

We reconcile our Chase account and it now looks like this:

Because we have been categorizing every new purchase to a category with a positive Budget Balance Within the Budget, we know that we can pay for them. We can choose to pay either the statement New Balance of $213.15 or our current balance of $219.27.

Perhaps you're like many of us and you have your account set to auto-pay the statement balance every month on the due date. Enter that transfer transaction on the due date.

If you use a Schedule for your auto-pay, edit the payment amount in your next Schedule to equal your statement New Balance.

Our Chase account now looks like this:

on the 18th, our Budget looks like this:

To budget and pay for a large purchase with your credit card, make a new category for it and add to it's Budgeted column every month until you have enough to pay for the purchase. When you make the purchase, categorize it to this new category and you'll know you have enough money to pay the bill when it comes. You did not create Overspending and stayed Within the Budget.

Be aware that when you do not pay at least the statement balance by the due date, you will lose your "Grace Period" and incur interest from the date of purchase for all new purchases. You will need to budget for this interest! It may take a few months of paying your statement balance in full to gain back your Grace Period.

Conclusion

Hopefully after looking through this example you've seen that managing credit card spending safely can be pretty easy if you stay Within the Budget.

On the other hand if some emergency comes up where you are unable to pay off the entire credit card statement, then you've overspent your money and are now in debt. This is perfectly okay, but it means that you need to switch over to following the Carrying Debt strategy for managing this debt.