Returns and Reimbursements

Returns

We have all been there. We purchased something that looked great at the time, but unfortunately it was the wrong size, didn't fit the purpose just as we had imagined, or we just decided that we didn't really need it and now we have to return it. But how do we do that with our budget? The thing to remember is that even though the money from this return will be flowing in to your budget, it isn't income. You used a budget category when you bought the item, so the most appropriate method to return that money to the budget is to allow the return amount to flow directly back to the category that was used to purchase it.

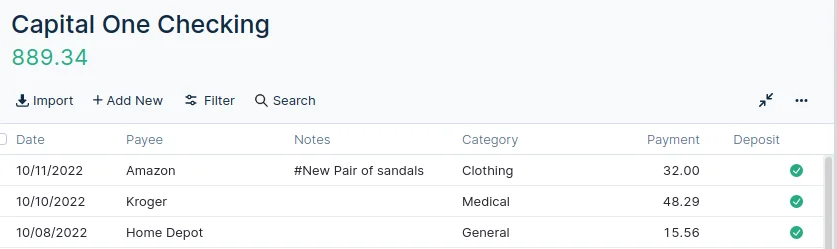

You can see from this view, I've bought a pair of sandals from Amazon that I was really excited about...Until they didn't fit.

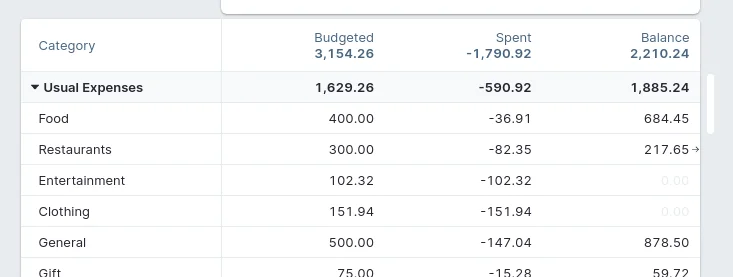

From the Budget screen, you can see I've spent every last dollar of my clothing category for the month.

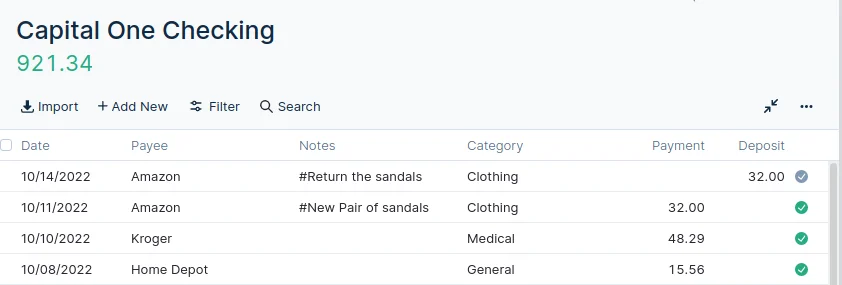

I didn't like those sandals as much as I thought I did. They made my feet look big. So I decided to return them a few days later. To enter the return, I fill out a nearly identical transaction in the account that will be credited. In my case, I had Amazon put the money back on my Debit card. Instead of putting the return amount in the payment column, I've entered the amount in the Deposit column. I also made sure that I chose Clothing as my category.

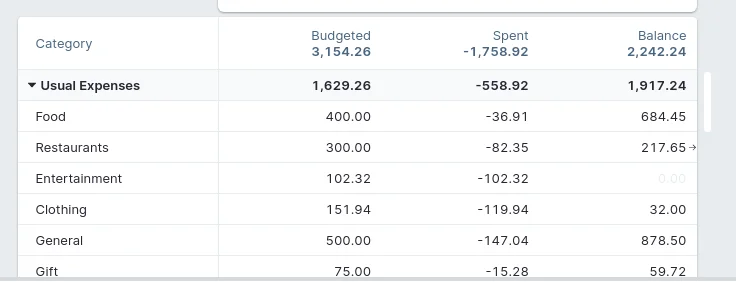

Now when I check my budget, I have 32 dollars available to spend on clothing for the month.

Reimbursements

Handling reimbursements can be confusing. There are several ways to handle them in your budget and you may use each way at different times depending on the circumstances. When it comes to reimbursements, it is assumed you will be covering some purchases that you would not normally make in your normal monthly budget. Having a special category in your budget that captures these purchases is not uncommon. There are two fundamental ways to manage reimbursements. The first is by carrying debt and the second is to pre-fund the category. Ideally, carrying debt is a last resort. But if the reimbursable expense is large compared to your current on budget account balances, there may be no other reasonable way.

In this scenario, all of your reimbursable expenses would go to a credit card. Credit cards have negative balances in the account view until they are paid in full, because after all, they are a debt product. You will also want a category that is meant for these reimbursable expenses. Maybe a Business category or Shared Expenses category will fill that role. Whatever category name you choose, you need to make a decision. Will you be pre-funding this category and allowing it to draw down towards 0 until you're reimbursed or will you let the category be overdrawn and carry a negative balance and then refill the category when you are reimbursed.

Pros of pre-funding

This is the true zero-budget way. Pre-funding is just budgeting. You know you're going to spend some money, so you allocate money to spend. The end.

Cons of pre-funding

It ties up available cash and you may not be able to fund other categories as fully as you would like.

Pros of not pre-funding

Your regular categories can be funded at normal levels.

Cons of not pre-funding

You don't have a zero based budget. This is essentially debt spending since you aren't allocating money to cover the expenses. If you spend too much on debt, you could run into a situation where you overdraft or start carrying a balance on a credit card.

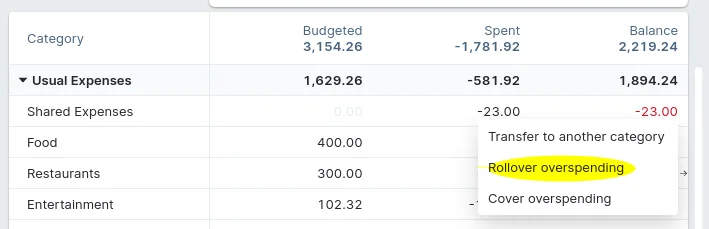

Cover the spending by end-of-month or rollover

Ultimately this is a personal decision. If you are capable, there is less short term risk if the category is pre-funded. If you choose to let the category remain negative and fill it up when you are reimbursed, don't forget to toggle the "Rollover Spending" option on the category just in case you aren't reimbursed in the same month. If you already carry a credit card balance month-to-month, cover the reimbursable overspending by the credit card category so when you pay the credit card bill it's a little easier to manage.

Once enabled, a little arrow will be shown next to each row's 'Balance' sum in the Budget view. It signals that over spending will be carried over from month to month. Check out the overspending section in "How Budgeting Works" for an explanation of this feature.

Adding the reimbursement transaction

When you are reimbursed, you can use the same technique from the Returns section. Add a new transaction to the account the reimbursement is being deposited into and choose the category you used to track your spending.