Carrying Debt

When you have an outstanding negative balance that you are unable to pay in full you are "carrying debt". We highly recommend that you do not do this for any new spending as it becomes super easy to accidentally fall deeper into debt. Instead, we recommend that you follow the Within the Budget strategy for any new credit card purchases. In case you're already carrying a negative balance on a credit card, this page will outline how to safely manage the debt without having to worry about going into more debt.

Always prioritize that your actual expense categories are funded before allocating money to paying down the debt. This will allow you to ensure that you're paying it off in a sustainable manner without accidentally incurring more of it over time.

To make it easier to follow along, the examples with screenshots are at the end.

This step-by-step guide is based on entering transactions manually and clearing and reconciling accounts from a monthly statement. It's too easy to spend aimlessly when you sync all your purchases. Manual entry and reconciliation keeps you in touch with your spending and associated accounts. When you have paid off your debt, you can link up your card(s) and reconcile from a bank sync.

Let's Pay Off that Debt!

Before we get started, check the settings for your Credit Card accounts to make it easy to see everything that's going on and we are on the same page:

-

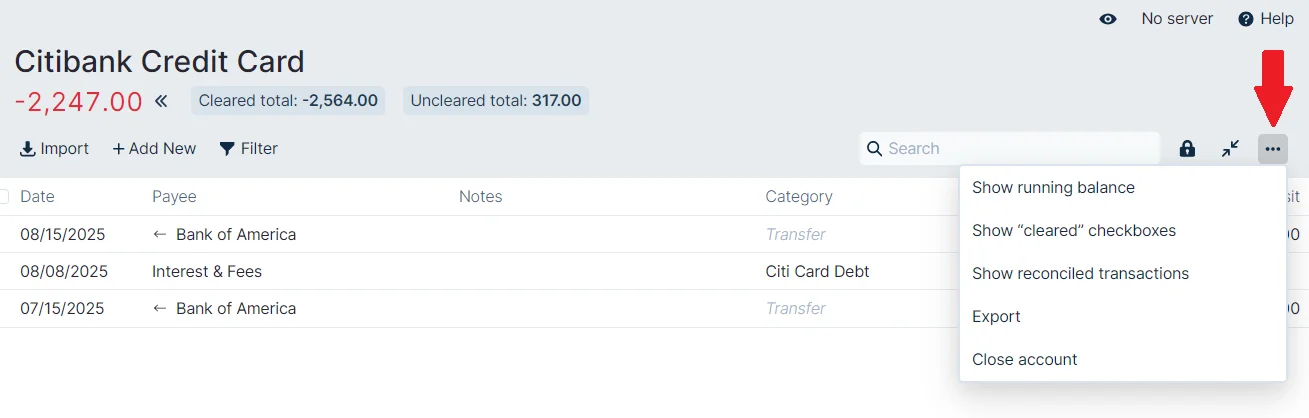

Using the 3-dot menu on the right of the account page, choose the following:

-

Show running balance

-

Show "cleared" checkboxes

-

Show reconciled transactions

-

-

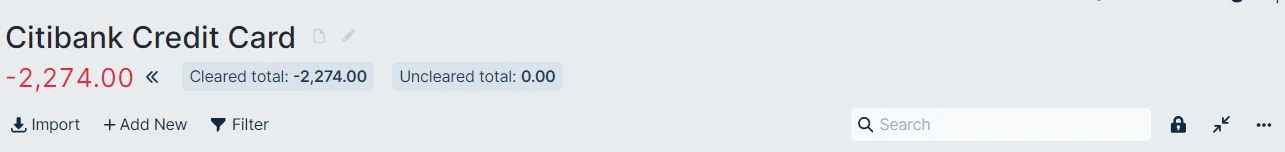

Check that the pills showing "Cleared total" and "Uncleared total" are showing under the account name.

-

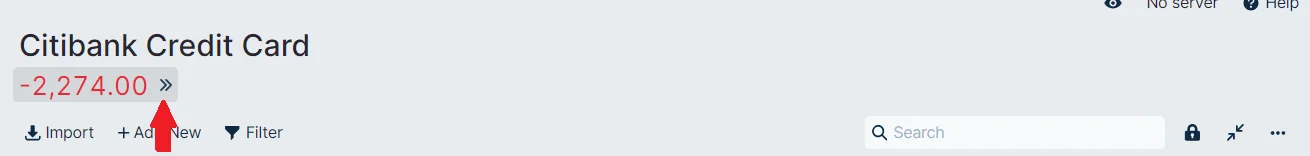

To show the pills, hover over the account balance under the account name and press the expand >> arrows.

-

- When we use the "Uncleared total" or account "Balance" from Actual we will use the absolute value, the positive value without the (-) sign. So, if Actual shows "Uncleared total: -2553.86", then we will use 2553.86.

- For our purposes here, we will be paying the credit card from a checking account.

- While you are paying off your credit card(s), it is best to use a debit card or cash. If that is not possible, and you have a card with no debt, use that one to make new purchases so you can pay it in full every month using Paying in Full - Within the Budget and work to pay off another. In any case, use only one credit card for new purchases and pay off the one with the highest interest first.

- We recommend doing this On Budget. If you will not use the card again after it's completely paid off and you have received a statement with a $0 balance, you can close the account.

Setting Up Actual Budget for Credit Card Debt

- Create a Credit Card Debt Category Group

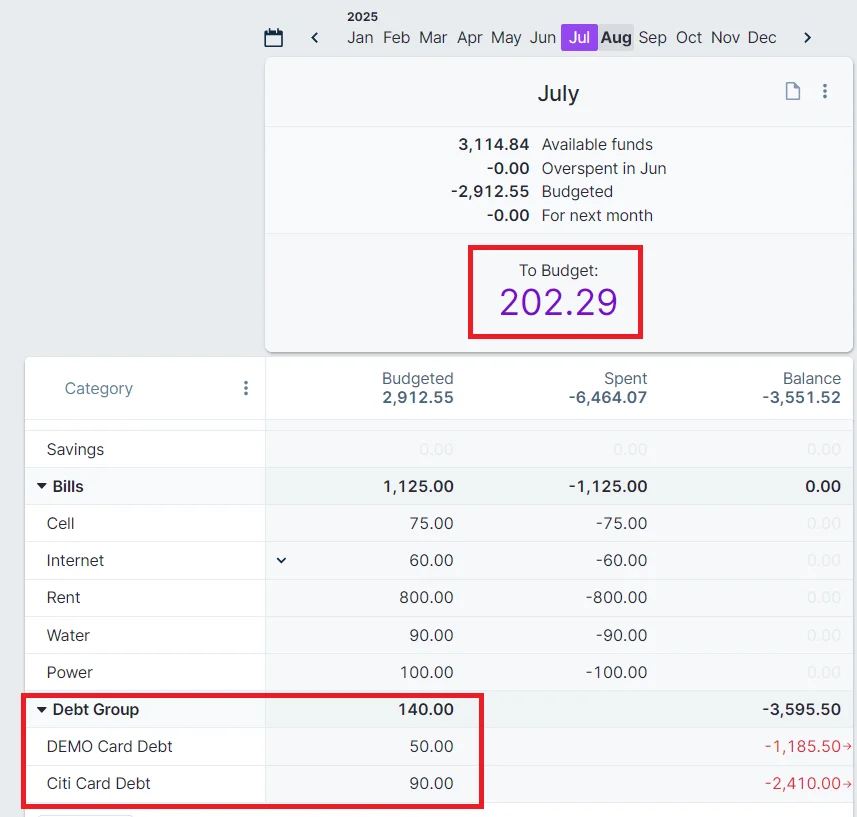

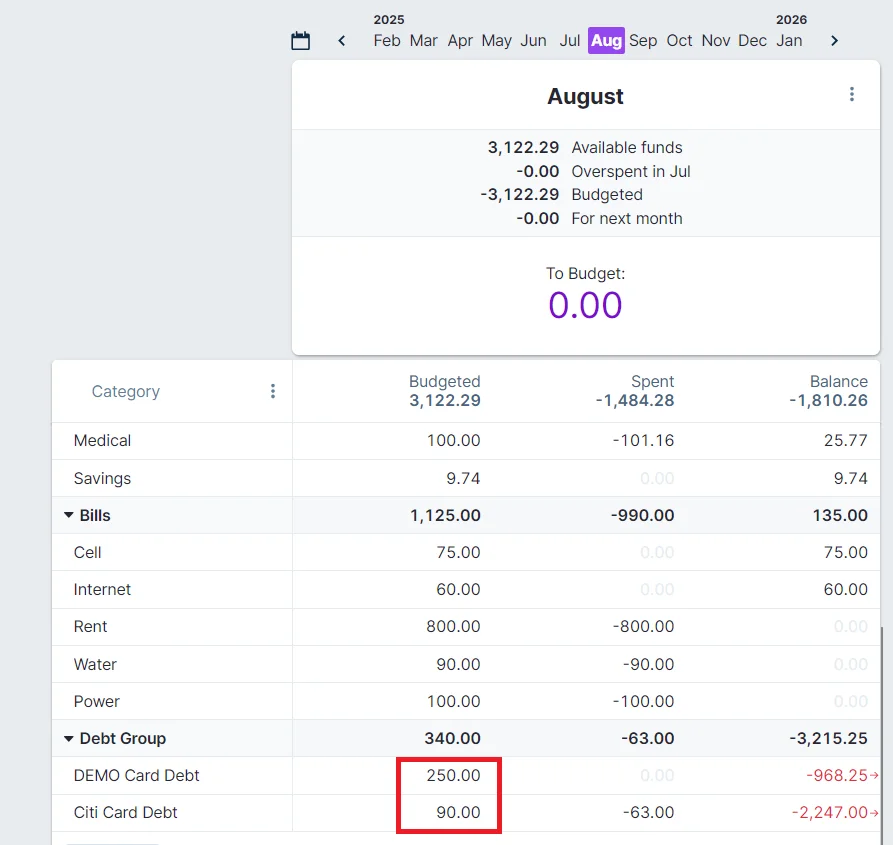

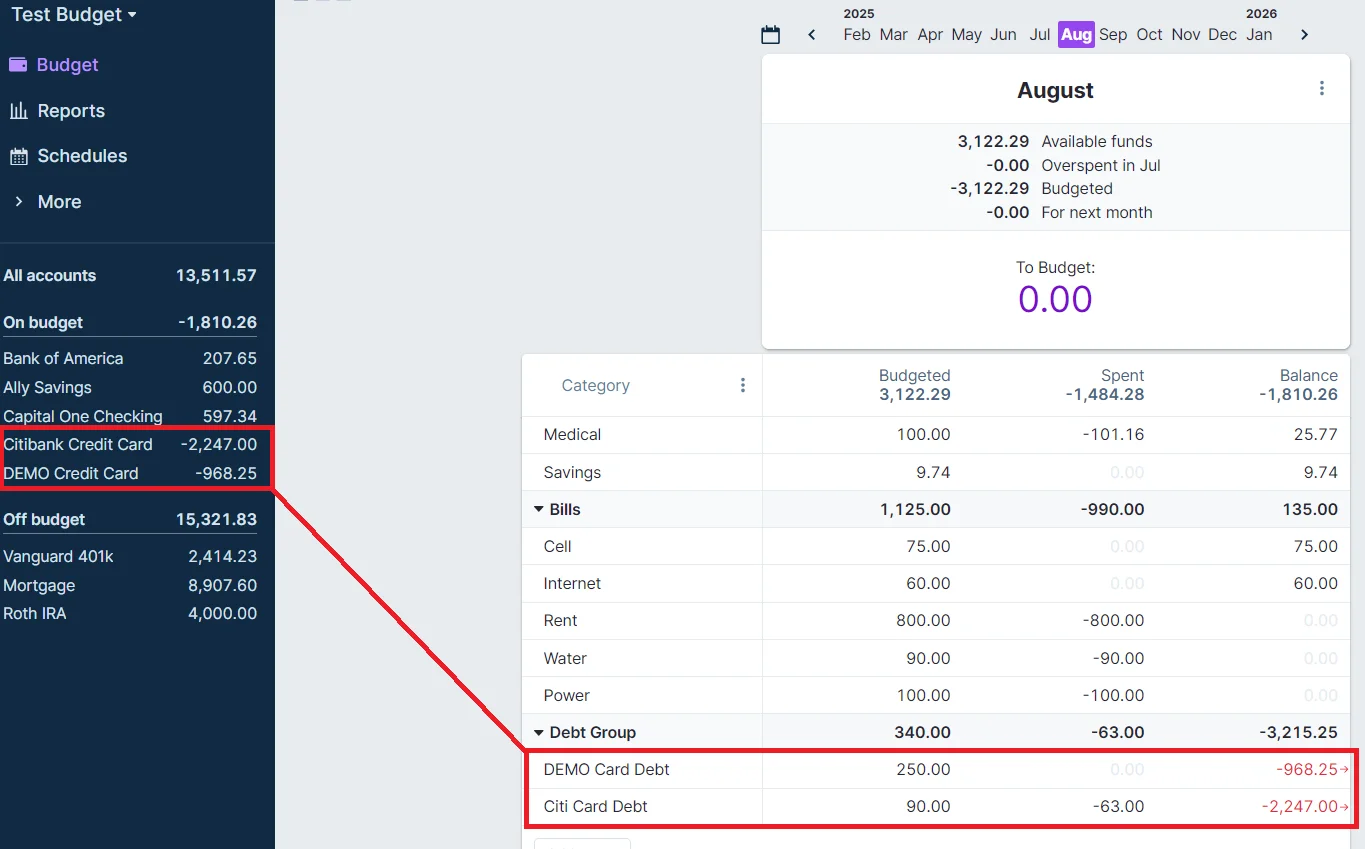

- Create a separate Bank Card Debt category in the group for each card carrying debt. Set them all to Rollover Overspending. In our example below, we used Citi Card Debt and DEMO Card Debt.

- To set Rollover Overspending, click on the category's Balance and choose it. A little arrow will now show next to the Balance. When you are rolling over overspending, the negative Budget Balance won't be reflected in your "To Budget" amount. Negative credit card account balances are already subtracted from your "Available funds" On Budget, we don't want to subtract them twice!

- For each credit card account, input a starting balance equal to the total amount owed. Include all transactions to date, as if you wanted to close the account. This starting balance goes in the "Payment" column. Change the category on this starting balance to Bank Card Debt.

- Remember, categorize any purchase that will not be paid for at the next statement as Bank Card Debt as it will add to the outstanding debt.

If you have been paying the statement balance in full every month, but need to incur debt for an emergency purchase enter the transaction normally, but categorize it as Bank Card Debt. Use the note field for a note or tag as to why. You can even use a split transaction if you only need to incur debt on part of the purchase!

Monthly Workflow

All Cards with Debt

- You must make Minimum Payments.

- Credit card banks calculate the Minimum Payment by adding 1-3% of the Statement Balance to the Interest & Fees. As you can see, paying only the minimum can mean staying in debt for many years!

- At the beginning of the month, assign the expected Minimum Payment amount to the Budgeted column for each Bank Card Debt category. One easy way to calculate the Minimum Payment is to use the one from the last statement.

- Each month when you do your budgeting, after you've accounted for all necessary expense categories, including the minimum payments on each credit card in the Credit Card Debt Group, you can add extra to the credit card you want to pay off. Choose to pay off the card with the highest interest rate first. In the Budgeted column, Add the extra amount to the Minimum Payment you assigned earlier. For example, if your expected Minimum Payment is $113.23 and you want to pay an extra $100, change your Budgeted column to 213.23 for that card debt category.

Cards with Original Debt and No New Purchases

- If you are not paying off the debt on this card:

- When your statement arrives, create the Interest & Fees transaction in the Credit Card account and categorize it to Bank Card Debt.

- Reconcile your account.

- Make sure the amount in the Budgeted column for Bank Card Debt is at least the statement Minimum Payment. If you need to add to it to reach the Minimum Payment, cover any overspending by transferring from another category with a positive balance.

- Use Make Transfer to transfer the amount in the Budgeted column from your Checking account to the Credit Card account. Send that amount to the Credit Card Bank to pay your bill.

- If you are paying off the debt:

- When your statement arrives, create the Interest & Fees transaction in the Credit Card account and categorize it to Bank Card Debt.

- Reconcile your account.

- Make sure the amount in the Budgeted category is higher than the statement Minimum Payment. One day your Minimum Payment will pay off the card completely! Happy Day!

- Use Make Transfer to transfer the amount in the Budgeted column from your Checking account to the Credit Card account. Send that amount to the Credit Card Bank to pay your bill.

Cards with New Purchases and Original Debt - Following the Paying in Full - Within the Budget Strategy

- During the month, enter your New Purchases and Return Credits as they occur. Categorize them to a Budget category that has a positive Balance, "Groceries", "Clothes", "Transit", etc.

- When your statement arrives, find the following information:

- New Balance, Minimum Payment, Interest & Fees, Returns/Credits and New Purchases. We will use this information to reconcile and calculate your payment.

- In the Credit Card account, create a transaction for Interest & Fees and categorize it to Bank Card Debt.

- Reconcile the account. Clear each and every transaction with your statement, including the Interest & Fees and Return Credits. Fix any problems before you move on. We do not advocate using a Reconciliation Transaction to fix any problems, especially when you are carrying debt. Before you "complete" the reconciliation, you can add up your cleared purchases and make sure the sum matches the "New Purchases" amount from your statement. The first month will be the most difficult - it will get easier!

- Looking at your statement, the very least amount you need to pay to not increase your debt is the Interest & Fees and your New Purchases minus the Return Credits. Remember, you accounted for and funded the interest at the beginning of the month when you budgeted for the expected Minimum Payment and you were setting aside funds to pay for New Purchases each time you categorized them! You can pay for them all without worry.

- If you are not paying off any original debt on this card, make sure the Budgeted column is at least the Minimum Payment. The Minimum Payment you budgeted for at the beginning of the month should have this covered. If the Minimum Payment is more than you expected due to Interest or Fees, add an amount to the Budgeted column to equal the statement Minimum Payment. Cover any additions to the Budgeted amount by transferring from another category with a positive balance.

- If you are paying off the debt on this card, make sure the current Budgeted column is more than the Minimum Payment. It should be at least the sum of the Interest & Fees plus the extra amount you want to pay off, but it will probably be a bit more and that's OK!

- Now let's calculate your payment.

- Your payment is the sum of the New Purchases from your statement (minus any return credits) plus the "Uncleared total" from Actual plus the amount in the Budgeted column of Bank Card Debt.

- This is the same as the difference between the Account Balance in Actual and the Category Balance of Bank Card Debt.

If the calculated payment is less than the statement Minimum Payment, you must make the statement Minimum Payment! In this rare case, add an amount to the Budgeted column so your resulting payment adds up to at least the statement Minimum Payment. Cover any additions to the Budgeted amount by transferring from another category with a positive balance.

- Use Make Transfer to transfer the calculated amount from your Checking account to the Credit Card account. Send that amount to the Credit Card Bank to pay your bill.

One day you won't need to add any extra to pay the credit card bill in full! Happy Day! Keep on paying at least your statement balance every month and soon you will gain back your Grace Period and stop accruing interest on new purchases! Follow the Paying in Full - Within the Budget strategy and you will never carry debt or pay credit card interest again.

Examples:

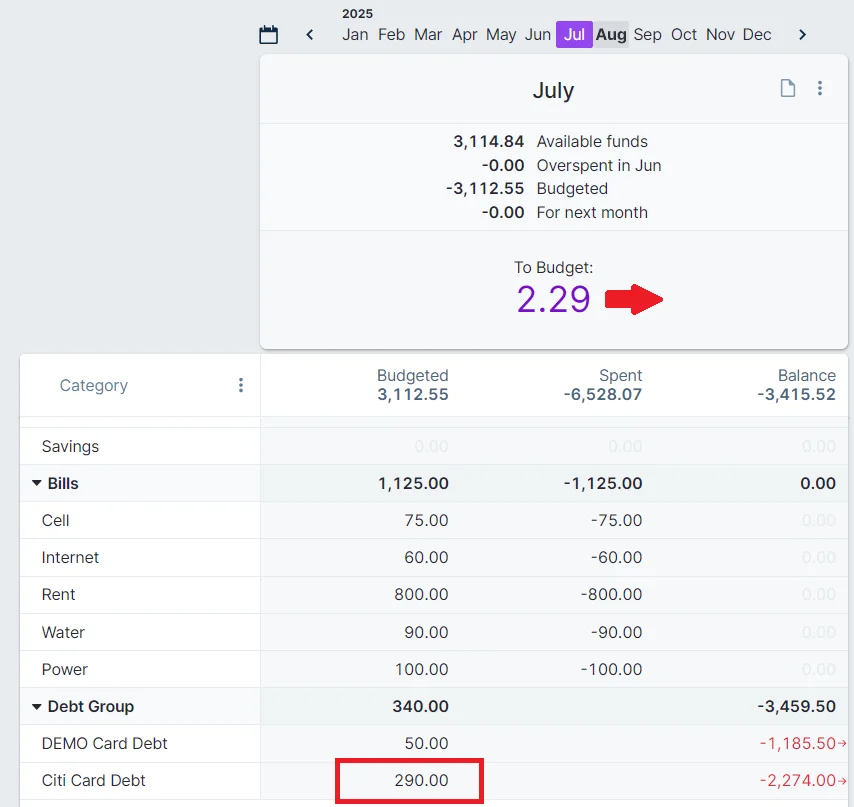

At he beginning of July we budget for the expected Minimum Payments as part of our necessary expenses. After all of our expenses are accounted for, we have $202.29 leftover and we decide to add $200 extra to our Citibank Credit Card. We add $200 to our $90 expected Minimum Payment. The $2.29 we Hold for next Month.

During July we spend using the Paying in Full - Within the Budget strategy. We use the DEMO Credit Card for some of our purchases. We are not spending using the Citibank Card.

The Citibank Statement arrives. We need the following information from the summary:

Citibank Account Summary

- Previous Balance: $2,590.00

- Payments Received: $90.00

- New Purchases: $0.00

- Cash Advances: $0.00

- Fees Charged: $0.00

- Interest Charged: $64.00

- New Balance: $2564.00

- Minimum Payment Due: $90.00

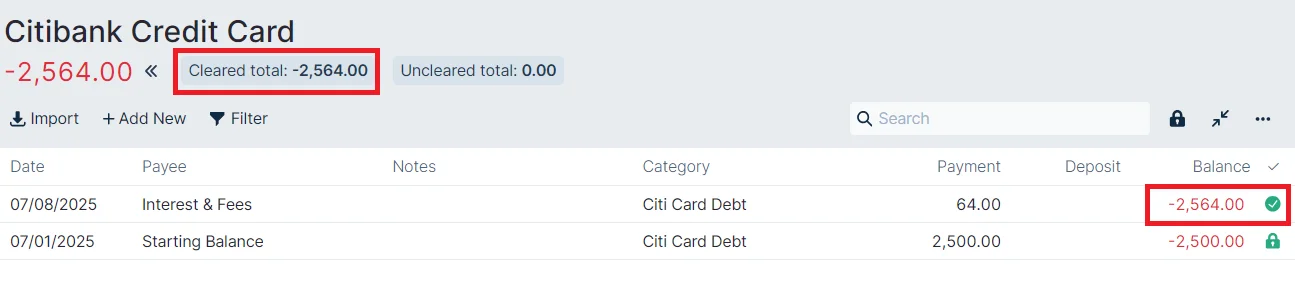

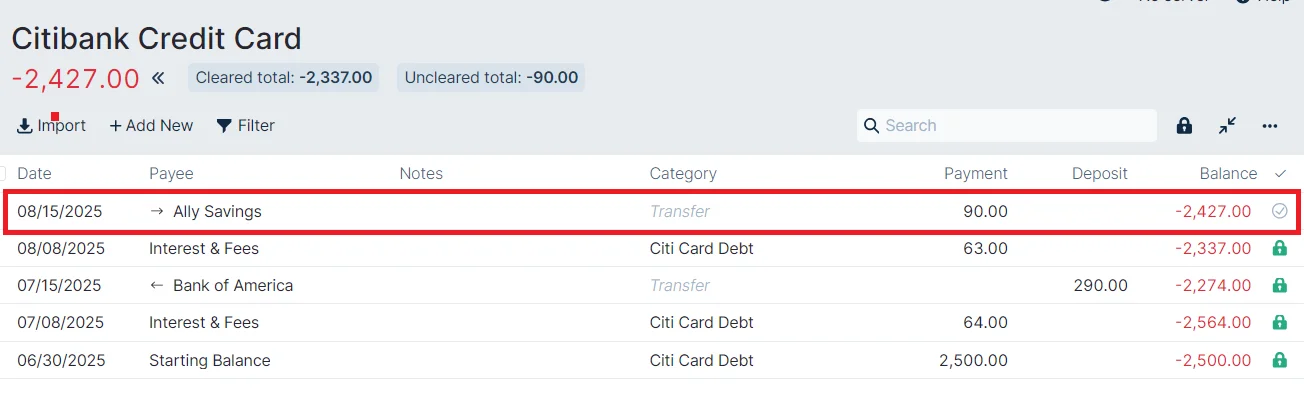

Following Cards with Debt and No New Purchases we enter a transaction into the Citibank account for the Interest & Fees and categorize it to Citi Card Debt. We reconcile the account, agreeing with Citibank that our New Balance is $2564.00.

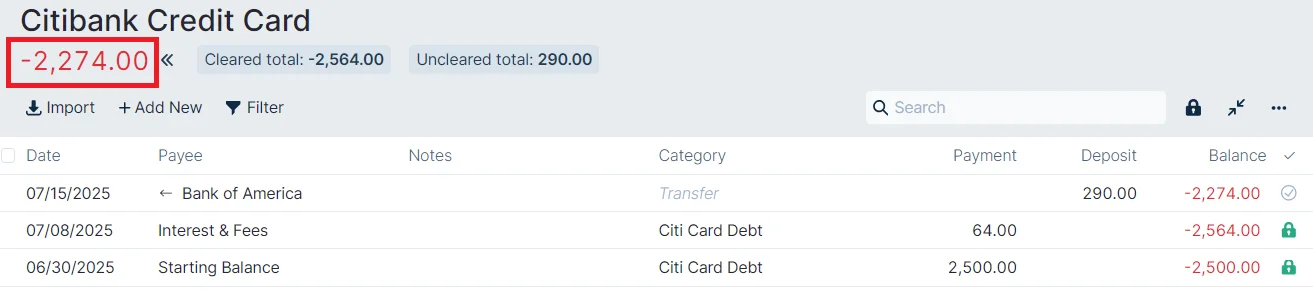

Our Budgeted amount of 290.00 is larger than the Minimum Payment of $90.00, so we send Citibank $290.00 and use Make Transfer to transfer that amount from the Checking account we used to pay the bill.

You may notice that the Citibank Balance matches the Citi Card Debt Balance. The Interest & Fees we added to the debt were canceled by our Budgeted amount that included them.

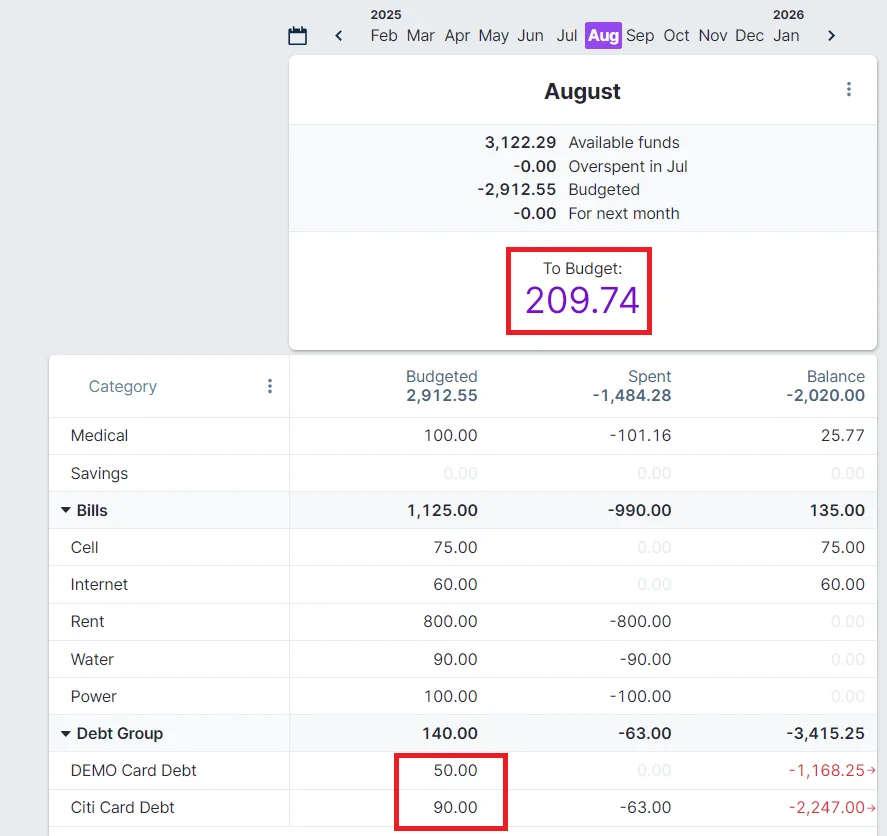

On the 1st of August we set our budget and start with our Minimum Payments of $90 for the Citibank card and $50 for the DEMO card. After we funded all of our necessary expenses we added an extra $200 payment for the DEMO card this month.

In August we receive our DEMO Card statement and we need the following from the account summary:

DEMO Account Summary

- Previous Balance: $1,235.50

- Payments Received: $50.00

- New Purchases: $846.11

- Cash Advances: $0.00

- Fees Charged: $0.00

- Interest Charged: $32.75

- New Balance: $2,064.36

- Minimum Payment Due: $50.00

We'll follow Cards with New Purchases and Original Debt above to calculate our payment.

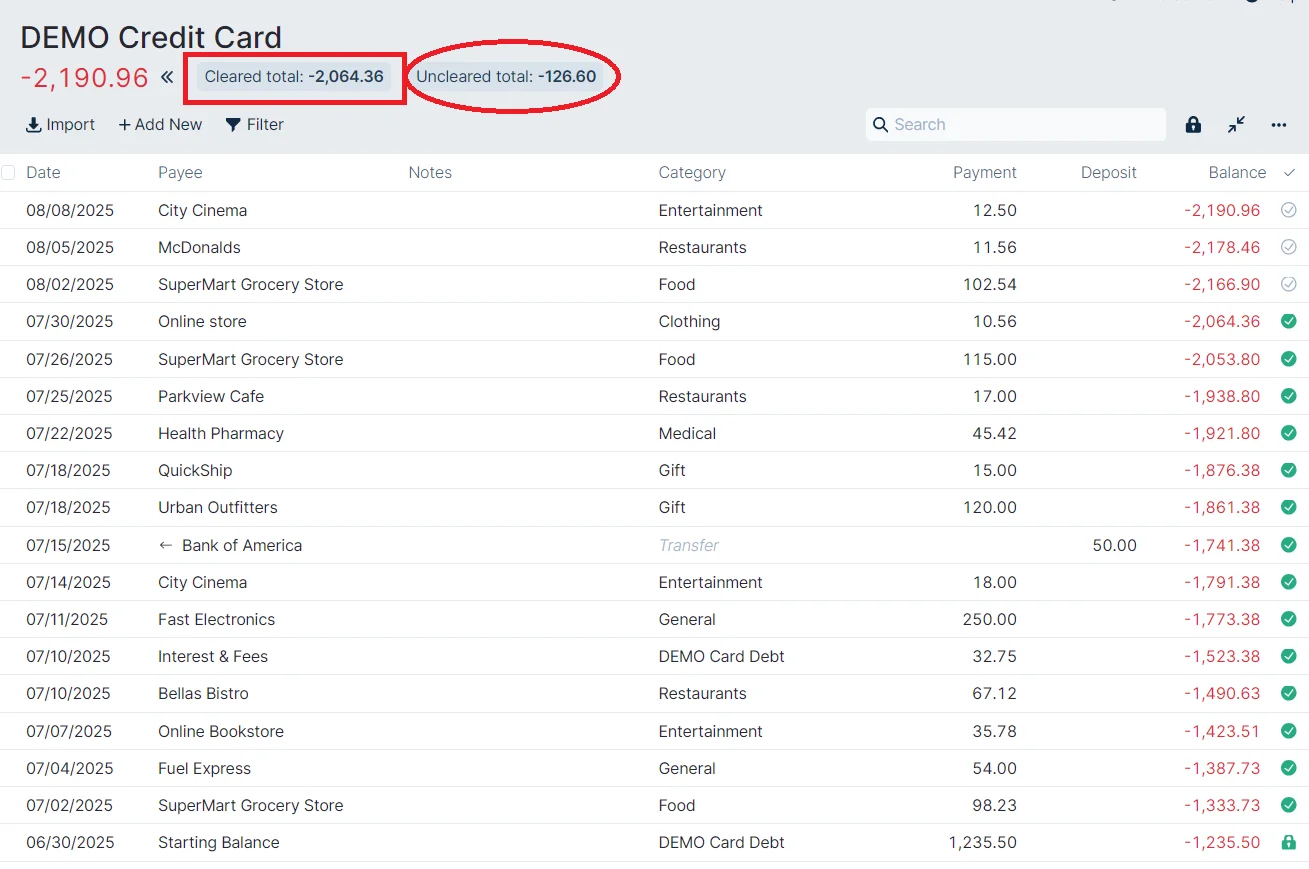

First, we'll enter the Interest & Fees transaction of $32.75, categorize it to DEMO Card Debt and start to reconcile our account. When our cleared transactions match the statement New Balance, our DEMO account looks like this:

Our cleared new purchases add up to $846.11 and match our statement, so we're good to go! Before we complete the Reconciliation, let's calculate our payment for this month.

- We have added some extra to pay down our debt this month, so our Budgeted column of 250.00 on DEMO Card Debt is definitely greater than either the Minimum Payment or the Interest & Fees of $32.75.

- So, the numbers we need are:

- New Purchases (statement): $846.11

- Return credits (statement): $0.00

- Uncleared total (Actual): $126.60 (Remember to use the absolute, positive, value)

- Budgeted column (Actual): $250.00

- Our payment calculation is:

New Purchases - Return credits + Uncleared total + Budgeted column, or

846.11 - 0.00 + 126.60 + 250.00 = 1222.71

OR

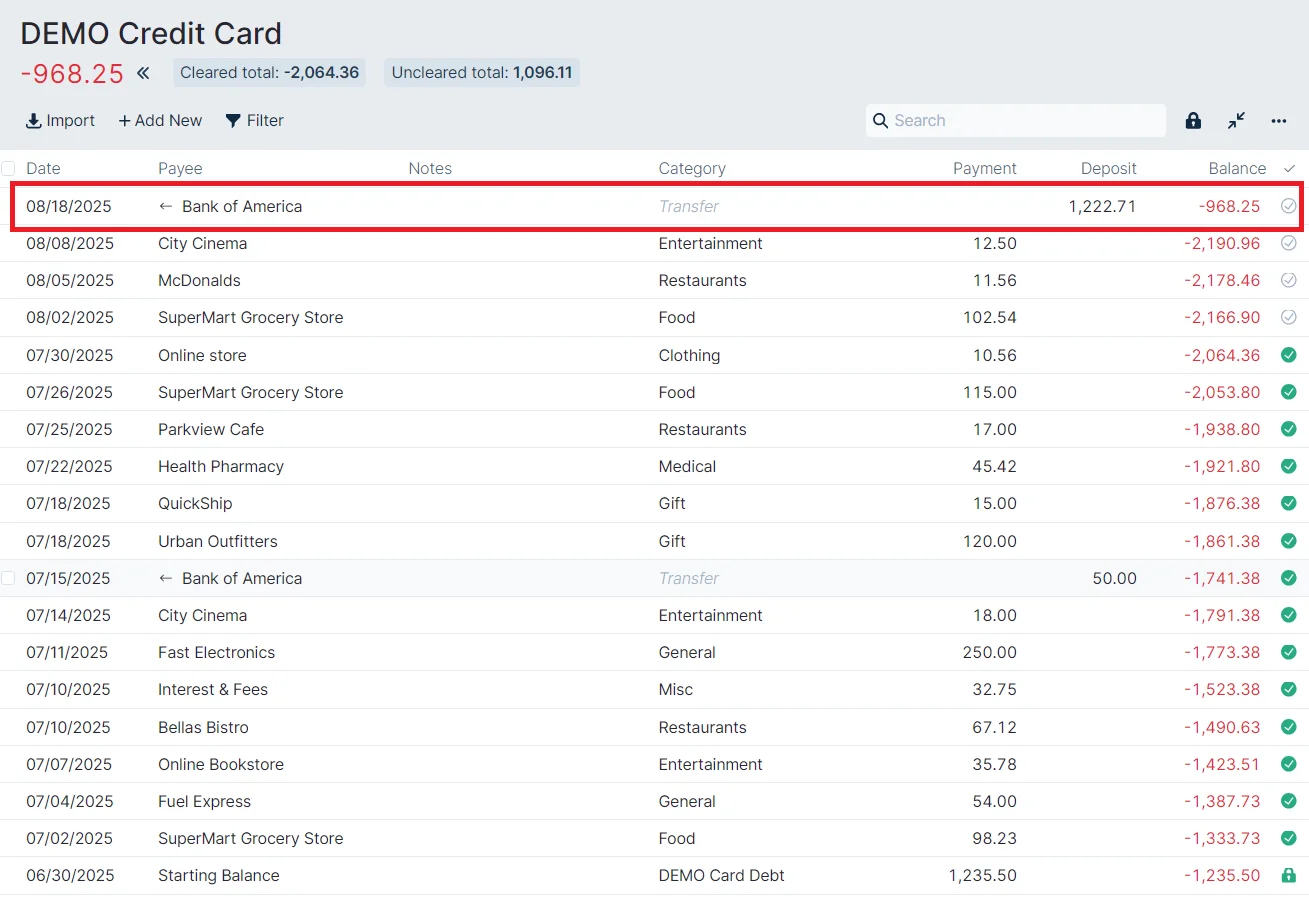

The difference between the Account Balance of -2190.96 and the Category Balance of -968.25 (2190.96 - 968.25 = 1222.71) - We send DEMO Bank $1,222.71 and use Make Transfer to transfer that amount from the Checking account we used to pay the bill. Our DEMO Account now looks like this:

We complete the Reconciliation and we are done with this account!

For our Citibank card this month we'll pay the Budgeted expected Minimum Payment of $90.00.

We have reduced our original debt to DEMO Bank to $968.25 and Citibank to $2,247.00. You can notice that for this snapshot in time, our credit card balances match our outstanding debt in the Budget.

We'll continue to spend Within the Budget, choosing a category with a positive Balance for each expenditure.